As the world moves towards digitalization, the demand for virtual payment solutions is on the rise. The Redotpay virtual card offers a modern, secure, and flexible way to manage online transactions. Here’s how the Redotpay virtual card is setting new standards in digital payments.

1. Instant Issuance and Use

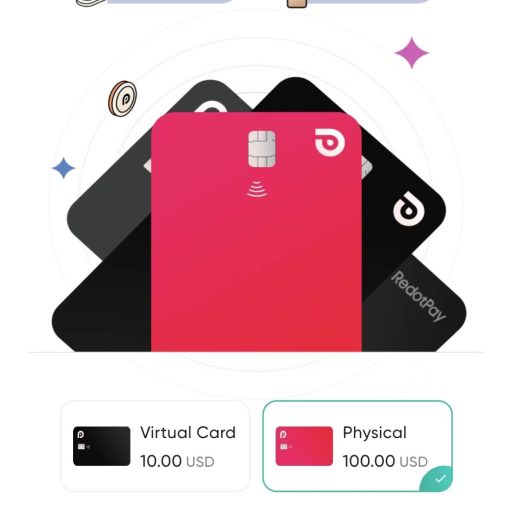

One of the primary advantages of the Redotpay virtual card is the instant issuance process. Unlike traditional cards, which require waiting for physical delivery, the virtual card is generated immediately within the Redotpay app. Users can start using their virtual card for online purchases as soon as it’s created, providing unmatched convenience.

2. Enhanced Security Measures

Security is a critical aspect of digital transactions. The Redotpay virtual card enhances security by providing unique card details for each transaction. This reduces the risk of card information being compromised. Additionally, users can generate disposable card numbers for one-time use, further protecting their financial data.

3. Seamless Online Shopping Experience

The Redotpay virtual card is optimized for online shopping. It can be used on any e-commerce platform that accepts major credit and debit cards. The convenience of having a virtual card means users can make secure online purchases without the need to carry a physical card, streamlining the online shopping experience.

4. Control and Flexibility

The virtual card offers unparalleled control and flexibility. Users can set spending limits, restrict usage to specific merchants, and even pause the card if necessary. These features allow users to manage their spending habits effectively and ensure that the card is used according to their preferences.

5. Global Accessibility

The Redotpay virtual card supports multiple currencies and can be used for international transactions. This global accessibility makes it an ideal choice for frequent travelers and individuals who make purchases from international vendors. The card’s ability to handle various currencies simplifies cross-border transactions.

6. Eco-Friendly Solution

Opting for a virtual card is also an environmentally friendly choice. By reducing the need for physical card production and delivery, users contribute to a decrease in plastic waste and carbon emissions. The Redotpay virtual card aligns with sustainable practices, making it a responsible choice for environmentally conscious consumers.

7. Integration with Digital Wallets

The Redotpay virtual card seamlessly integrates with various digital wallets and mobile payment solutions. This compatibility ensures that users can incorporate their virtual card into their preferred payment methods, enhancing the convenience and versatility of their financial transactions.

By offering instant access, advanced security, and unparalleled flexibility, the Redotpay virtual card is at the forefront of digital payment solutions. It provides users with a safe, convenient, and eco-friendly way to manage their online transactions, embodying the future of digital finance.

답글 남기기